Projects

Final Evaluation of the Budget Support Program "ENPARD Moldova – Support to Agriculture and Rural Development"

The main objective of this project is to provide an overall independent assessment of the past performance of the “ENPARD Moldova – Support to Agriculture and Rural Development" program, paying particular attention to its results measured against its expected objectives, and the reasons underpinning such results. Meanwhile, key lessons learned, conclusions, and corresponding recommendations will be presented in order to improve future budget support programs.

The evaluation will be carried out according to the EU’s guiding documents and methodologies – notably complying with Better Regulation Guidelines and Evaluation methods, the relevant regulations for financing external actions and instruments, scoping the whole results chain (intervention logic), the priority guidelines of the European Consensus and the related EU Development and Cooperation Results Framework, the OECD’s DAC quality standards and criteria for evaluation, the OECD’s methodological approach for evaluating budget support (the latter relates to only Step 1 and part of Step 2), and using the methods and techniques for intervention logic, eligibility criteria, and performance assessment reflected in the EU’s Budget Support Guidelines.

The evaluation will be conducted using five DAC evaluation criteria (relevance, coherence, effectiveness, efficiency, and sustainability) as well as the EU-specific evaluation criteria known as EU added value. It will take into account cross-cutting issues and interlinkages with SDGs as well as whether the principle of “leave no-one behind” and the rights-based methodology were followed in the identification/formulation documents and the extent to which these were followed during implementation.

While the main focus of the evaluation will be on the achievements and results, it will also pay attention to the quality of design, the coordination of planning of different modalities, the efficiency of BS and CS inputs to attain direct outputs, the achievement of the induced outputs by the main stakeholders, the effectiveness of the attainment of outcomes, as well as actual impacts and sustainability factors.

Based on the indicative evaluation questions listed in the ToR, after initial consultations and document analysis during the inception phase, the evaluation team will propose in the Inception Report a complete and finalized set of evaluation questions with an indication of specific judgement criteria and indicators, as well as the relevant data collection sources and tools.

One of the first steps of the evaluation process is to reconstruct the intervention logic of the Program to evaluate how this relates to the choice of BS performance indicators/specific disbursement conditions and the nature of complementary assistance ToRs and mechanisms. These aspects will be examined for consistency with program objectives and rationales in the relevant identification and action documents and the Technical and Administrative Provisions (TAPs) and the appendices of the financing agreement.

Determining the evaluation questions and agreeing on the evaluation matrix are the key tasks of the evaluation, with a focus on the achievement of a common understanding of their scope and content with the EU Delegation and the key government stakeholders that make up the Evaluation Reference Group. Once the evaluation questions are finalized as well as the judgement criteria and indicators, the collection of relevant sources of information and data can begin, followed by analysis and validation. Thereafter, the findings will be synthesized into conclusions, lessons learned and, where appropriate, recommendations.

The evaluation will comprise the following phases:

- Inception and Desk Phase: the program’s intervention logic is clarified or reconstructed; the evaluation questions (EQs) and related criteria and indicators to be addressed by the final report are agreed; key stakeholders as sources of documentation and potential interviewees are identified; and a future evaluation workplan and schedule is agreed. An initial examination of documentation will inform the evaluation matrix and the planning of activities and objectives for the Field and Synthesis Phase. This phase is to conclude with an Inception Report, including agreed/reconstructed intervention logic, an evaluation matrix, stakeholder analysis, and a workplan;

- Field and Synthesis Phase: interviews are conducted with relevant representatives of key stakeholders, culminating in an Intermediary Note providing initial findings with respect to the EQs in light of discussions held and analysis of documents. The main output of the Field and Synthesis Phase is a draft final report, detailing and justifying the key findings. This will be presented to the reference group for comment prior to finalization.

Subscribe

NEWS

On September 9, we presented the findings of the research entitled “Investment and Export Promotion via Diagonal Cumulation between Georgia, Türkiye, and the European Union” at a forum organized by the Ministry of Economy and Sustainable Development of Georgia with the support of the USAID Economic Security Program, the EU, and GIZ.

We recently started working on a new project entitled “Communal Infrastructure for Environment and Tourism Improvement - Lot 2: Accompanying Measures,” aimed at improving the living conditions of people in four Georgian municipalities (Baghdati, Vani, Samtredia, and Kazbegi) through improving the supply of hygienically-sound drinking water and environmentally-safe sanitation infrastructure.

We recently completed a project entitled “Executive Roundtable (ERT) Session on Non-Profit Budgeting Process,” carried out by the USAID HICD Activity and implemented by the Kaizen, Tetra Tech company, aiming to facilitate collaboration, collective learning, and organizational development in the non-profit budgeting process with a cohort of selected organizations, including the Georgian Young Lawyers Association (GYLA), the Georgian Institute of Politics (GIP), and the Georgian Association of Social Workers (GASW).

On September 19-23, the International Consortium on Governmental Financial Management (ICGFM) is hosting the 2022 International Conference at the University Club of Washington DC, offering the first opportunity in over two years for the global PFM community to gather in-person to network and connect with leading professionals and colleagues from across the world, in a unique and distinguished setting.

On July 28, PMCG supported a workshop organized by the EU and the Ministry of Environmental Protection and Agriculture of Georgia as part of the project “Support to Environmental Protection and Fight Against Climate Change in Georgia.”

PUBLICATIONS

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti. In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti. The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year. In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year. The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025. In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

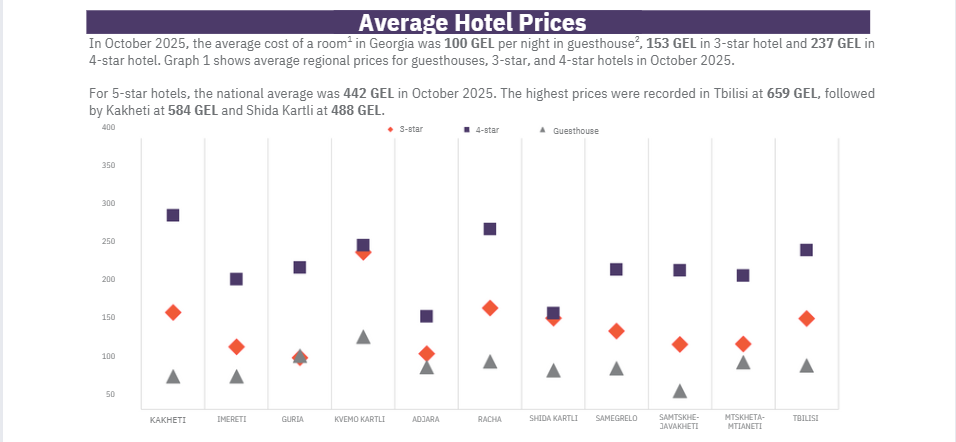

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti. In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti. The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year. The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%). Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.